News

News and announcements

18 Feb. 2026

Kristín Gunnarsdóttir has been appointed Head of Media & Research, a new department within Landsbankinn’s Communications & Culture Division that will commence operations at the end of February. The department will encompass the Bank’s PR team and its Economic Research Department. Una Jónsdóttir, Chief Economist of Landsbankinn, will continue to lead the Economic Research team within the new department.

18 Feb. 2026

Landsbankinn has renewed its partnership agreement with Svanni - the Women's Loan Guarantee Fund, for the next four years. The renewed agreement is valid throughout September 2029.

12 Feb. 2026

Landsbankinn’s Annual Report for 2025 has now appeared. The Annual Report reviews key aspects of operation, service innovations for families, individuals and companies, the continuous development of digital solutions and more.

11 Feb. 2026

Today, Landsbankinn concluded an auction of Additional Tier 1 (AT1) securities.

5 Feb. 2026

Styrkás hf., through its subsidiary Skeljungur ehf., has signed a purchase agreement providing for the acquisition of all share capital in Gallon ehf. The seller is Skel fjárfestingafélag hf.

29 Jan. 2026

Landsbankinn wishes to warn about fraudulent emails currently in circulation, spoofing the Bank’s name and image. The content of the emails is a false notification claiming that the recipient must click a link in the email to confirm a transfer.

29 Jan. 2026

Landsbankinn's profit in 2025 was ISK 38.0 billion after taxes, as compared with ISK 37.5 billion the previous year.

16 Jan. 2026

The Central Bank of Iceland has decided to change the maximum amount limit in its interbank system.

14 Jan. 2026

We are happy to announce that TM has joined our Aukakrónur partnership. Everyone who is insured with TM gets a 1% refund in the form of Aukakrónur when paying with a card linked to the Aukakrónur system. You can also use your Aukakrónur to pay for insurance.

7 Jan. 2026

Landsbankinn and Drift EA have entered into a partnership agreement aimed at supporting innovation and entrepreneurship in Iceland by strengthening the framework, advisory services and networks available to entrepreneurs and startups.

5 Jan. 2026

KLAK – Icelandic Startups and Landsbankinn have renewed their partnership for innovation competition Gulleggið with the signing of a new three-year agreement. With this agreement, Landsbankinn further strengthens its role as the competition’s main sponsor and underscores its long-standing support for Icelandic innovation.

19 Dec. 2025

Landsbankinn’s Customer Service Centre and branches will be closed on Christmas Eve Day, Christmas Day, Boxing Day and on New Year’s Day. On New Year’s Eve, branches will be closed but the Customer Service Centre open between 9-12:00.

12 Dec. 2025

Community grants in the total amount of ISK 20 million were awarded from Landsbankinn’s Community Fund Monday 8 December 2025. A total of 32 initiatives received financial support this year. The projects are varied and benefit people of all ages and throughout Iceland.

10 Dec. 2025

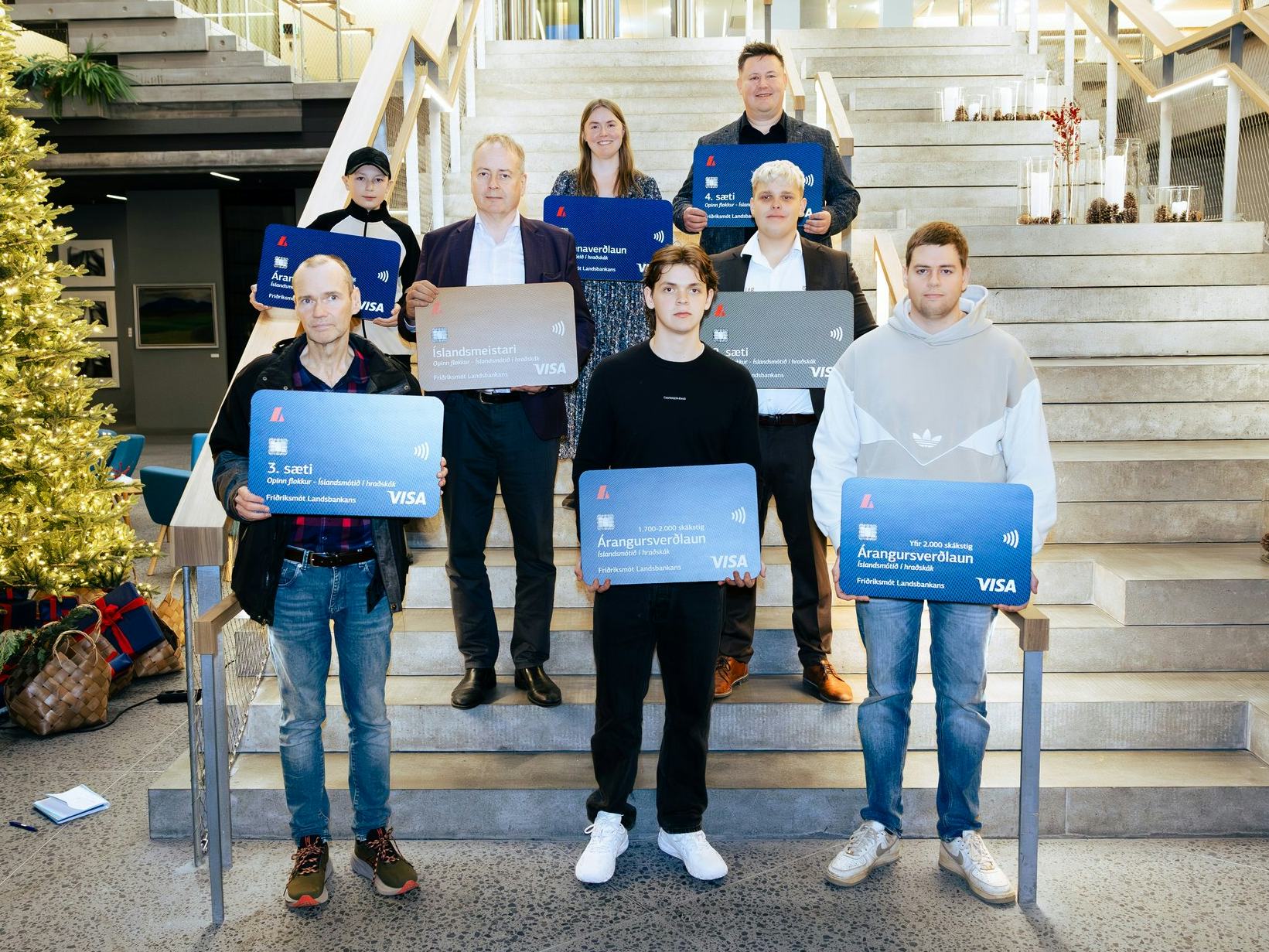

Grandmaster Jóhann Hjartarson was the clear winner at Landsbankinn’s Friðriksmót, the Icelandic rapid chess tournament, held at the Bank’s headquarters at Reykjastræti 6 on 7 December 2025. Jóhann was unstoppable and won with a score of 11½ out of 13, an incredible margin in a strong and exciting tournament.

4 Dec. 2025

In early November, Landsbankinn launched its first ever online game, designed to heighten awareness of and knowledge about cybersecurity. By using an interactive media such as the game form, players were made active participants in their own security.

4 Dec. 2025

Landsbankinn participates in and is a torchbearer for the initiative Þín íslenska er málið organised by Almannarómur, the Icelandic Centre for Language Technology. The aim of the project is to gather data and sources about the Icelandic use of companies from various sectors. Different industries and business sectors often use a highly specialised vocabulary, concepts and terms that are not commonly used, yet still a crucial part of our linguistic world.

4 Dec. 2025

The Central Bank of Iceland has determined that New Year’s Eve, 31 December, will not be counted as a banking day going forward.

26 Nov. 2025

The lights will be lit on the Hamburg Christmas tree for the 60th time on 29 November at 17:00 during a festive ceremony and to the accompaniment of merry music, courtesy of the Hafnarfjörður Brass Band.

24 Nov. 2025

Landsbankinn lowers loan and deposits rates. Variable rates on non-indexed housing mortgages decrease by 0.25 pp. Fixed rates on new housing mortgages decrease by 0.10-0.20 pp.

18 Nov. 2025

As in previous years, Landsbankinn has donated to a good cause in the name of all Exceptional Companies recognised by Creditinfo. This year, the donation of ISK 4 million goes to Örninn.

14 Nov. 2025

Due to a system updates, customers will not be able to use the app and online banking on Sunday night through to Monday morning, from midnight to 04:00 on 17 November. Other self-service solutions will be inaccessible during work on the update.

11 Nov. 2025

Landsbankinn is an active creator of educational content, with publications ranging from economic analyses to general information about finances, cybersecurity and sustainability to participation in debate on current affairs. By sharing the great expertise that the Bank’s team possess, we aim to enhance financial literacy, contribute to financial health and have a positive impact on society.

27 Oct. 2025

Today, Landsbankinn concluded the sale of new 7-year green bonds in the amount of EUR 300 million. The bonds bear a 3.625% fixed rate and were sold at terms equivalent to a 122 basis point spread above mid-swap market rates.

24 Oct. 2025

Following the ruling of the Supreme Court of Iceland in an interest case against Íslandsbanki on 14 October 2025, Landsbankinn has made changes to its offering of housing mortgage loans.

23 Oct. 2025

Landsbankinn hf., Bál ehf. and Solvent ehf. have sold Greiðslumiðlun Íslands ehf. (GMÍ) in an open sale process that commenced in November 2024 to Síminn hf.

23 Oct. 2025

Landsbankinn’s after-tax profit in the first nine months of 2025 amounted to ISK 29.5 billion, ISK 11.1 billion thereof in the third quarter. Return on equity (ROE) was 12.2%, compared with 11.7% for the same period the previous year. The net interest margin as a ratio of average total asset position was 2.9%.

22 Oct. 2025

Landsbankinn's branches will be closed on Friday 24 October because of the Women’s Strike. The Customer Service Centre will be open but service can be expected to be slower than usual.

20 Oct. 2025

On 14 October 2025, the Supreme Court of Iceland delivered a judgement concerning terms on variable interest rates in an Íslandsbanki housing mortgage loan.

7 Oct. 2025

Companies have access to a large cache of data - about their customers, consumption patterns, procurement, inventory and more. How have Icelandic companies been using their data to arrive at better decisions and improve operations?

3 Oct. 2025

Due to maintenance work certain of Landsbankinn’s services will be unavailable Sunday night through to Monday morning, from 1:00 to 6:00 on 6 October.

- …