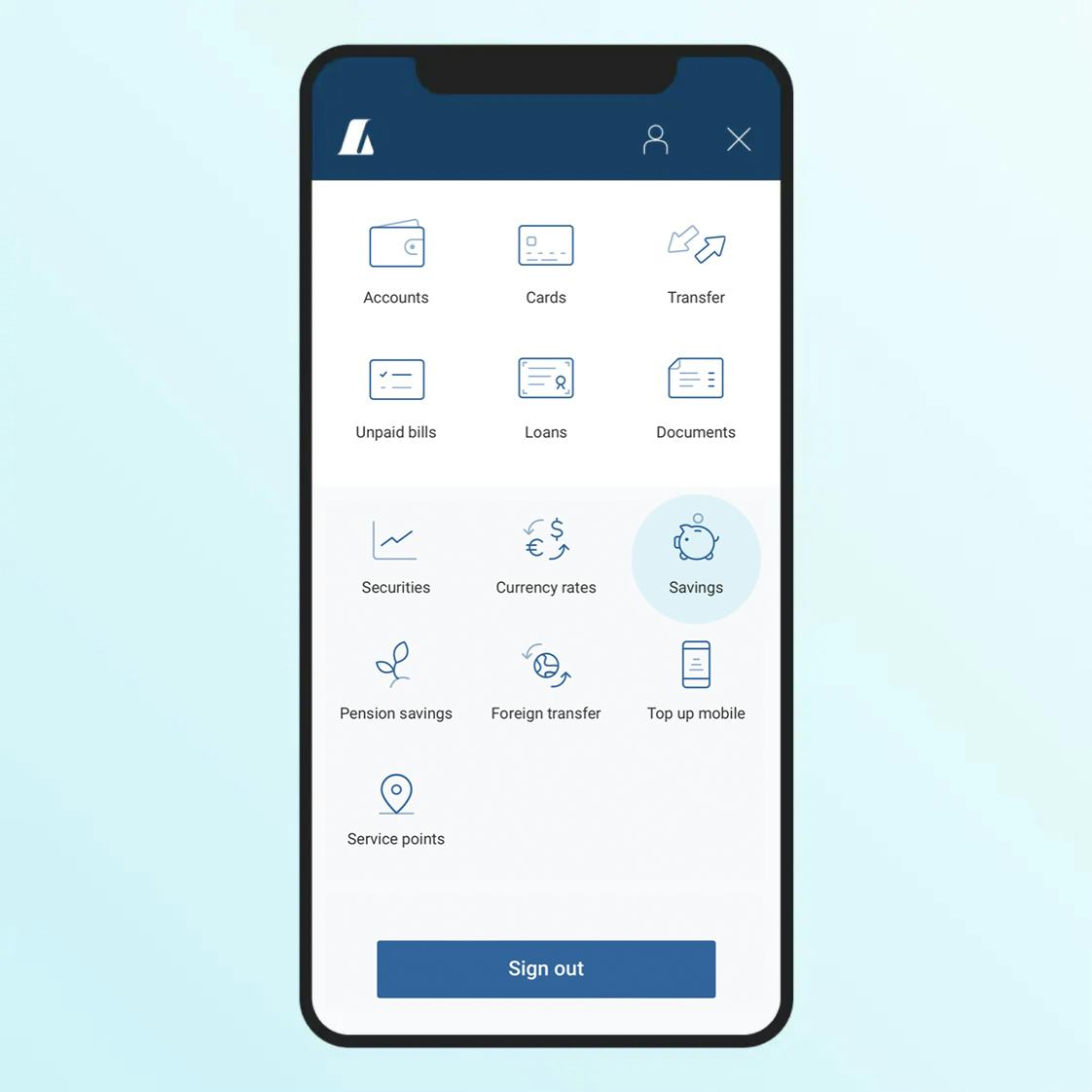

To start saving with a payment card, go to "Credit Card" in online banking and then select “Card Savings”.

Then select your savings plan:

- Each transaction is rounded up to the next ISK 100, 500 or 1,000, and the difference is credited to your savings account.

- Each transaction is increased by a fixed amount - ISK 100, 250, 500 or 1,000 - which is then credited to your savings account.

You shop as usual. We calculate the savings and deposit the amount into your selected savings account. Simple and convenient.

Note that it is not possible to save using a card with an overdraft.