We recommend that you also conclude an agreement for supplementary pension savings which gives you a pay increase of 2% you don't otherwise get.

Mandatory pension savings

According to law, the minimum contribution is 12% of wages, yet most collective bargaining agreements stipulate a minimum contribution of 15.5% with the wage earner always contributing 4% and the employer 8% or 11.5%. These pension contributions ensure a life-long pension.

Supplementary pension savings

If you are starting work in Iceland, we recommend that you conclude an agreement for supplementary pension savings paid to a private pension scheme. If you contribute 2-4% of your wages to supplementary pension savings, your employer will contribute an additional 2% of wages - a de facto wage increase you won’t get otherwise.

You can use your supplementary pension savings to purchase your first apartment in Iceland, both as a down payment and as an instalment on your mortgage. These payments are exempt from taxation and can be used over a 10-year period.

Does it matter where I invest my pension contributions?

Many people don’t see a huge difference between pension funds. This isn’t entirely accurate. What is unique about Íslenski lífeyrissjóðurinn is that you can decide how high a percentage of your mandatory pension savings will be invested in a private pension division.

Private pension is inherited in full. The portion of your contributions not invested in a private pension division is paid to a mutual division that ensures life-long pension as well as spouse’s, children’s and disability pension. In traditional pension funds, the lion’s share of pension contributions is invested in a mutual division for all fund members.

Íslenski lífeyrissjóðurinn is a smart option for those who wish to combine the advantages of mutual and private pension schemes.

Advantages of allocating part of mandatory pension contributions to a private pension scheme:

- Flexibility upon disbursement.

- Gives you the option of retiring earlier, as assets in private pension schemes are available for withdrawal at 60.

- Private pension savings are fully inheritable.

- Interest is not liable for capital income tax.

Payment plans

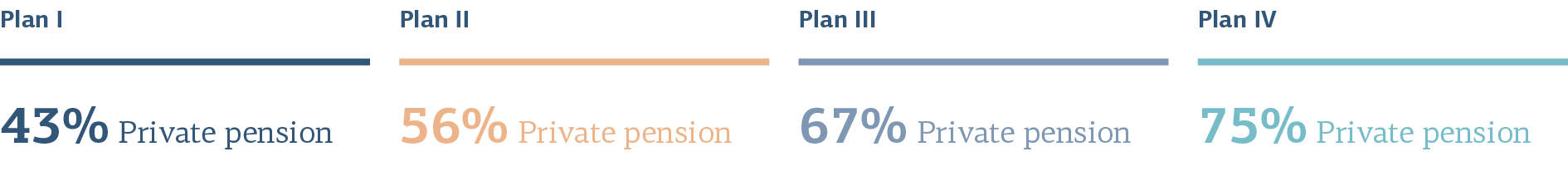

For mandatory pension contributions, you can choose between four payment plans with variously high private pension contributions. You can allocate between 43-75% to private pension that is fully inheritable (based on a 15.5% mandatory contribution).

We recommend payment plan I if you are just entering the labour market and have not accumulated rights in other pension funds. If this is the case, it can be good to build rights in a mutual division as well.

If you are nearing retirement, we recommend paying the majority of your contributions to a private pension division.

Investment options

We meet different needs and attitude to risk by offering varied investment options, 7 options for supplementary pension savings and 4 for mandatory pension savings.

Íslenski lífeyrissjóðurinn offers 4 independent investment options and for supplementary pension savings, we also offer Landsbankinn's Lífeyrisbók (an inflation-indexed and non-indexed account) and pension savings in a portfolio of international securities (Lífeyrissparnaður – Erlend verðbréf).

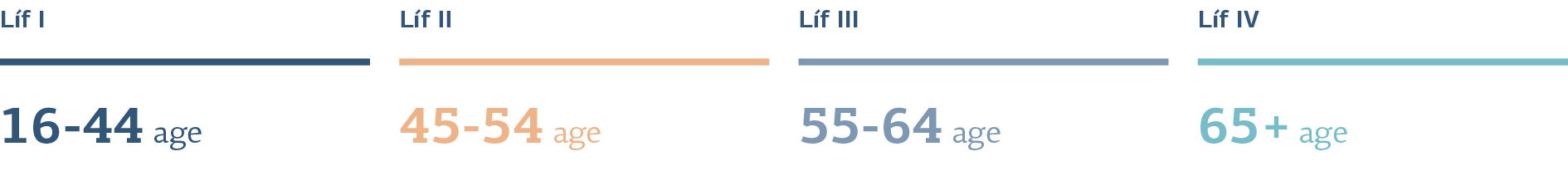

We recommend savings plan Lífsbrautin with Íslenski lífeyrissjóðurinn. This plan automatically transfers you between the four investment options as you grow older, reducing fluctuations as you near retirement age.

Take a look at returns over the past 15 years

Leaving Iceland

If you are emigrating from Iceland, you may be eligible to take out part or all of your pension savings with you.

Information about the regulations when moving to another country

If you are eligible to take out your pension when emigrating from Iceland, you are required to submit a disbursement request and the following documents:

- Copy of passport

- Confirmation of emigration from Iceland from Registers Iceland

You can contact Investment and pension services via vl@landsbankinn.is to have the disbursement application sent.

Disbursement

Disbursement of pension savings takes place at a certain age, disability or death. It is easy to apply for disbursement via the fund member portal or by contacting Landsbankinn Investment Services via email to VL@landsbankinn.is or phone to +354 410 4040.

Landsbankinn online banking

You’ll find information about the balance, rights and transaction statements for your pension savings in online banking under Pension savings.

The article was initially published 30 November 2022 and revised 4 November 2025.