Sustainability at Landsbankinn

Sustainability at Landsbankinn

We are leading in sustainability, an ambitious participant in public debate on economic affairs and an active publisher on varied informative topics.

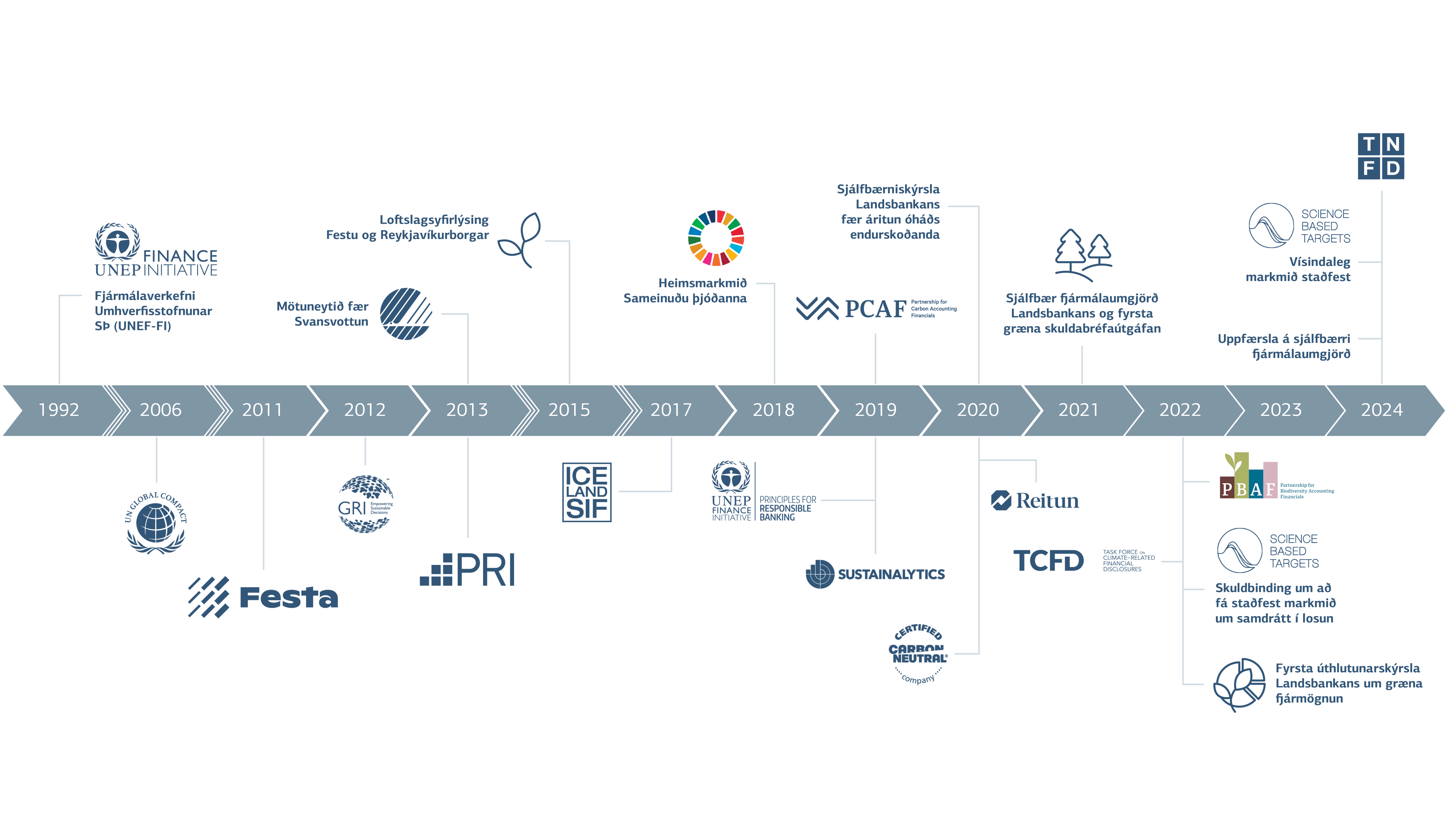

Sustainability journey and obligations

Landsbankinn has set itself the goal to be a leader in sustainability. See timeline above.

Landsbankinn’s Sustainable Finance Framework sets out criteria for its funding of environmental and social initiatives. Our Sustainable Finance Framework broadens our scope for financing green and social projects, such as switching to renewable energy, developing environmentally-friendly infrastructure and sustainable fisheries. We publish regular impact reports for sustainable financing with third-party verification to ensure that financed projects meet the criteria set forth in the Framework and to ensure transparency. The Framework has been reviewed by international rating firm Sustainalytics.

We have taken systematic steps to implement a strategy for responsible investment in recent years. Integration of environmental, social and governance (ESG) factors in the investment decision process has a positive impact on return on investment in the long term and reduces operational risk. Landsbankinn is a founding member of IcelandSIF. The Bank is also a member of UN PRI, UN PRB and the UN Global Compact.

Annual & Sustainability Report

The Bank’s Annual & Sustainability Report is a detailed review of our sustainability platform and its impact on the environment and society. We comply with current rules and regulations with relevant sustainability disclosure.

Emissions

We assessed carbon emissions from our loan book using the PCAF Standard carbon accounting method. This means that we know the scope of the Bank’s so-called financed emissions going back to 2019. Our latest report on the assessment of our emissions has been attested by an independent auditor. One of the main challenges banks have faced in the work to reduce their emissions the assessment of their indirect environmental impact, which is much higher than their direct impact. In Landsbankinn’s case, less than 1% of emissions are from direct operation. Data-based knowledge is key to the effort to limit global warming in accordance with the Paris Agreement.

Landsbankinn’s science-based emission goals verified

Landsbankinn’s goals to reduce greenhouse gas emissions have been verified by the Science Based Targets initiative (SBTi). We are the first Icelandic bank to achieve this. Landsbankinn’s goals are aligned with the aims of the Paris Agreement to limit global warming to below 1.5°C.

Carbon-offset operation

We have carbon-offset the Bank’s 2024 activity and renewed our internationally acclaimed certification from CarbonNeutral. We work with Climate Impact Partners to carbon-offset our operation through carbon sequestration or the avoidance of GHG emissions. Such sequestration complies with strict global standards and has already taken place.

Environmental

We know our environmental impact and carry out an in-depth analysis of both the direct and indirect environmental impact of our value chain based on the internationally approved GHG Protocol. We publish detailed information about the Bank’s environmental impact and emissions in our Annual & Sustainability Report, readily accessible on our website.

Community grants

We award ISK 15 million in community grants each year. Community grants are intended as support for a range of projects, including humanitarian organisations, projects in the fields of education, research and science, projects connected to culture and the arts, preventative measures and youth activities, and sustainability.

Sustainability Forum 2025

Landsbankinn hosted its fourth Sustainability Forum on 4 September 2025. All the presentations engaged the audience and the Forum was very well attended. Recordings from the Forum, abstracts from the presentations and accompanying slides are available on the Bank’s website (in Icelandic).

Join our group of satisfied customers

Applying for access to online banking and the app, creating an account and getting a debit card is a matter of minutes.