Please note that minor changes are set to be made to the website that appears when Visa cardholders are asked to confirm online purchase with code.

The changes will apply as of Wednesday, 10 November 2021.

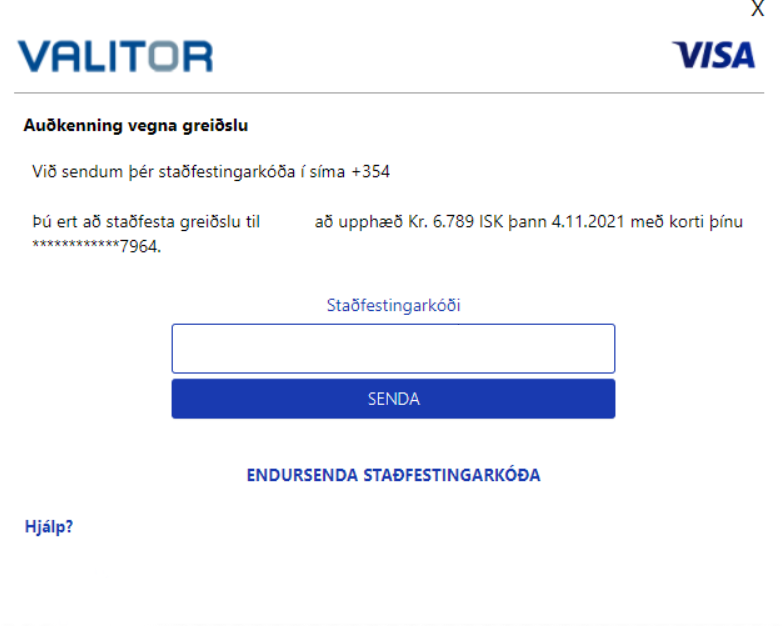

When a cardholder uses a card to pay for goods or service with an online merchant who uses Verified by Visa, a website appears, asking the cardholder to enter a secure code. The secure code is sent by Valitor via text message. The process is otherwise the same as before.

As of Wednesday evening, 10 November, the website will look like this:

It is vital to read carefully all messages from payment card companies, your bank or others, especially as regards online shopping. We have posted accessible information on cybersecurity here on Landsbankinn’s website (in Icelandic).

Further information on Valitor’s website (in Icelandic)