Saving in funds has many advantages and it's easy to start building an asset portfolio by creating a subscription.

What are the benefits of regular savings in funds?

Lower cost

With a fund subscription, you get a 100% discount on purchase fees and service charges.

A little goes a long way

The minimum monthly subscription amount is just ISK 5,000. You can increase the amount at any time but also tie it to an index so that the amount increases in line with the consumer price index at the beginning of each month.

Dollar-cost averaging

Timing the market is extremely difficult. It requires close monitoring of both the economy and market fluctuations which is both time consuming and hard to get right.

The dollar-cost averaging method involves regular investment in a fund at regular intervals over a certain period, regardless of price. This lowers the average cost per share and reduces the impact of volatility.

Diversification

By investing in funds, we achieve asset diversification that reduces risk as compared to investing in a single stock or bond. Funds invest in a selection of securities and deposits depending on their investment strategies.

Tax deferral

Capital income tax is paid when you sell in the fund, not on a monthly or annual basis like with savings accounts.

We take care of your investment!

All Landsbréf funds have fund managers who closely monitor and manage each fund's investments to achieve the best results.

What do I need to consider before buying in a fund?

Before you start investing in the stock market, you should set goals and determine a time frame for your investment. What is the goal of your investment and how long do you intend to invest for? Risk is another factor to consider - the longer the duration of an investment, the more risk it is generally possible to take. This is because market fluctuations, both up and down, can be considerable but tend to even out over time. Some of us are willing to take on more risk and are not sensitive to large fluctuations in returns while others have less tolerance and wish for less fluctuation and lower returns.

Attitude to risk can change with increased knowledge and experience of securities and trading. If you have limited knowledge of the securities market, it might be prudent to take less risk to begin with and let experience be your guide. Your financial position is a large factor here as is your tolerance of loss. In general, a stronger financial position allows you to take more risk, at least with a part of your portfolio. If you cannot tolerate any loss, you should consider lower-risk assets.

Another factor that reduces risk is asset diversification. It’s rarely recommended to put all your eggs in one basket but rather to diversify your investment both across asset classes (equities/bonds) and within them. By investing in funds you achieve asset diversification that reduces risk compared to investing in individual shares or bonds. Those of us who do not have expert knowledge of stock trading often invest in mixed funds managed by professionals. Such fund managers leverage their expertise to compile an asset portfolio based on pre-determined objectives and investment strategies.

What funds are available?

Once you've set your goals and examined both your financial position and risk appetite, you select a fund that suits your needs. Landsbankinn’s website provides a good overview of Landsbréf funds and their fluctuation tolerance. If you click on a specific fund, you’ll see more information about that fund. Fact sheets for the funds are all structured the same, allowing for easy comparison.

The example below shows how an ISK 20,000 monthly subscription develops over a 10-year period in various Landsbréf funds. The image shows the different fluctuations of the funds in the past 10 years.

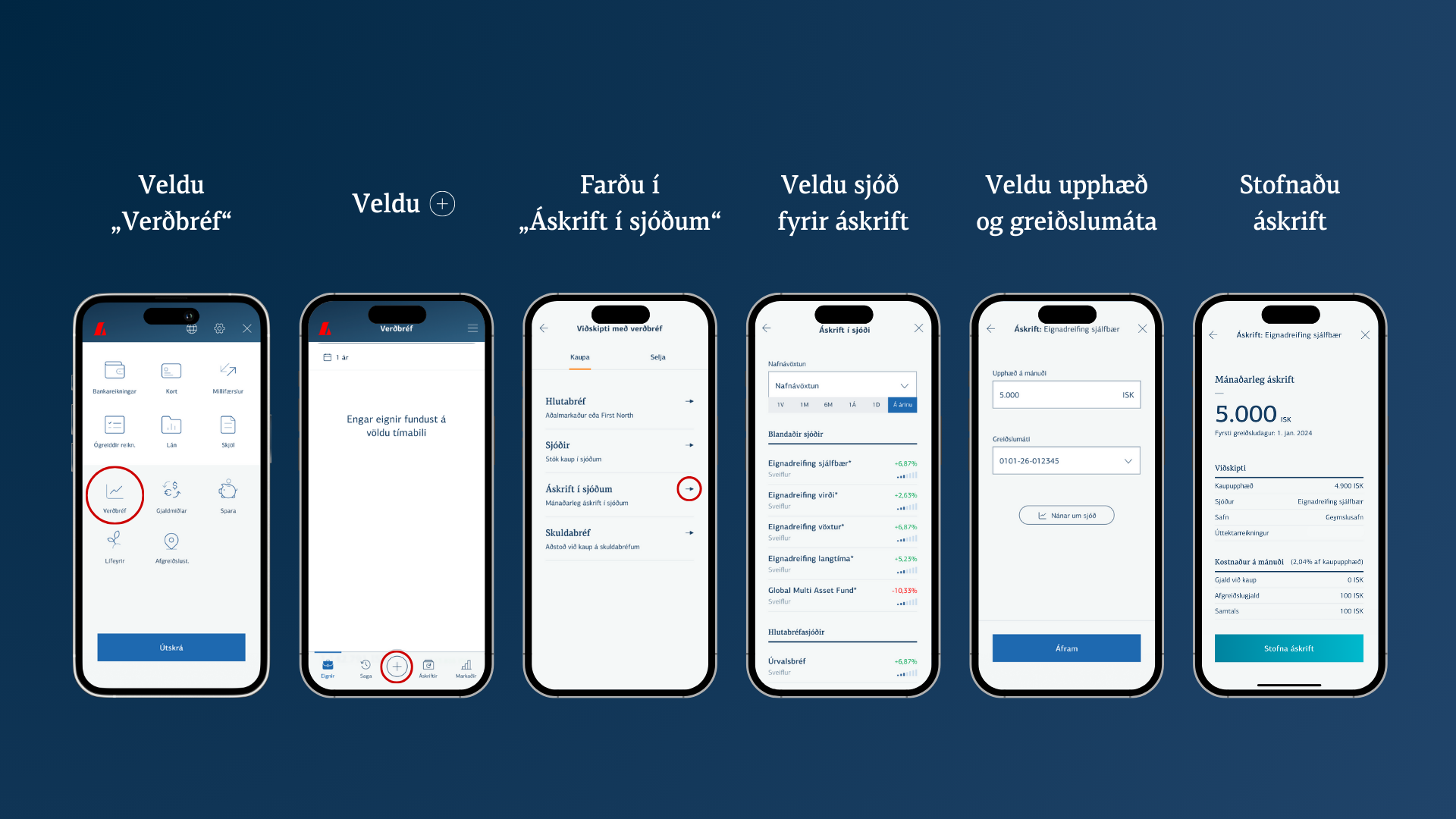

How do I create a subscription?

It’s easy to take out a monthly subscription in the app, on l.is and online banking under “Securities”.

We are happy to help if you need assistance and you’re always welcome to book a phone call from us at Investment & Pension Services. Good luck!