22 November 2024

Landsbankinn has made changes to the maximum loan term for new inflation-indexed mortgages and the loan-to-value (LTV) ratios for both indexed and non-indexed mortgages.

- The maximum loan term for indexed mortgages will be reduced from 30 years to 25 years. First-time buyers will still have the option to take out indexed mortgages with a 30-year term.

- For real estate purchases, primary loans will now cover up to 60% of the purchase price, with the possibility of obtaining an additional loan to cover up to 80%. First-time buyers can receive an additional loan of up to 85% of the purchase price.

- For refinancing, the primary loan will now be limited to 60% of the property's real estate value, with an additional loan available for up to 70% of the real estate value.

- Changes to LTV criteria do not affect the Bank’s existing borrowers. Customers who already have primary loans that exceed 60% of the real estate value will still be able to refinance them as primary loans.

The changes enter into effect as at 26 November 2024.

You may also be interested in

5 Feb. 2026

Styrkás hf., through its subsidiary Skeljungur ehf., has signed a purchase agreement providing for the acquisition of all share capital in Gallon ehf. The seller is Skel fjárfestingafélag hf.

29 Jan. 2026

Landsbankinn wishes to warn about fraudulent emails currently in circulation, spoofing the Bank’s name and image. The content of the emails is a false notification claiming that the recipient must click a link in the email to confirm a transfer.

16 Jan. 2026

The Central Bank of Iceland has decided to change the maximum amount limit in its interbank system.

14 Jan. 2026

We are happy to announce that TM has joined our Aukakrónur partnership. Everyone who is insured with TM gets a 1% refund in the form of Aukakrónur when paying with a card linked to the Aukakrónur system. You can also use your Aukakrónur to pay for insurance.

7 Jan. 2026

Landsbankinn and Drift EA have entered into a partnership agreement aimed at supporting innovation and entrepreneurship in Iceland by strengthening the framework, advisory services and networks available to entrepreneurs and startups.

5 Jan. 2026

KLAK – Icelandic Startups and Landsbankinn have renewed their partnership for innovation competition Gulleggið with the signing of a new three-year agreement. With this agreement, Landsbankinn further strengthens its role as the competition’s main sponsor and underscores its long-standing support for Icelandic innovation.

19 Dec. 2025

Landsbankinn’s Customer Service Centre and branches will be closed on Christmas Eve Day, Christmas Day, Boxing Day and on New Year’s Day. On New Year’s Eve, branches will be closed but the Customer Service Centre open between 9-12:00.

12 Dec. 2025

Community grants in the total amount of ISK 20 million were awarded from Landsbankinn’s Community Fund Monday 8 December 2025. A total of 32 initiatives received financial support this year. The projects are varied and benefit people of all ages and throughout Iceland.

10 Dec. 2025

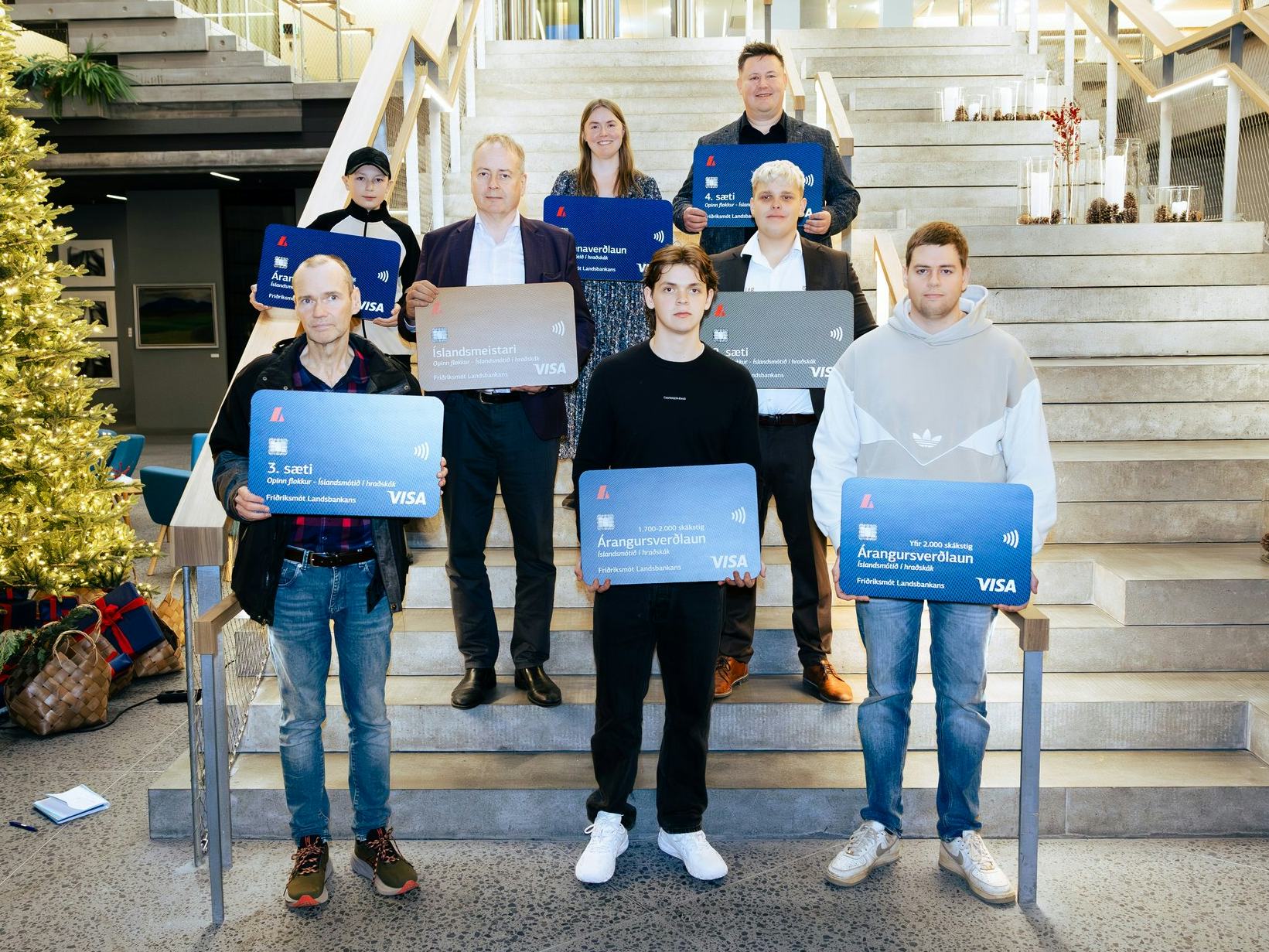

Grandmaster Jóhann Hjartarson was the clear winner at Landsbankinn’s Friðriksmót, the Icelandic rapid chess tournament, held at the Bank’s headquarters at Reykjastræti 6 on 7 December 2025. Jóhann was unstoppable and won with a score of 11½ out of 13, an incredible margin in a strong and exciting tournament.

4 Dec. 2025

In early November, Landsbankinn launched its first ever online game, designed to heighten awareness of and knowledge about cybersecurity. By using an interactive media such as the game form, players were made active participants in their own security.