Loans

Let’s find the right loan for you

Whether you’re looking for a long or short-term loan, for a lower or higher amount, this is where you’ll find the type of financing that suits your needs.

Housing mortgages

Your path to a new home starts here. We finance up to 85% of the purchase price of housing.

Lower debt service or the option to speed up asset formation? Landsbankinn offers two types of loans, inflation-indexed and non-indexed, and interest rates can be fixed or variable.

Indexed or non-indexed?

Inflation-indexed loans are linked to inflation, meaning that the principal of the loan can increase early in the loan term. This leads to slower asset formation. While the principal may increase due to inflation, this does not necessarily mean that your financial position is worse, because real estate prices tend to follow inflation in the long term. Interest rates on indexed loans are generally low and debt service lower.

Non-indexed loans are not linked to inflation, meaning that the loan never increases, merely decreasing steadily over the loan term. This results in quicker asset formation and lower instalments as the loan term progresses. Interest rates on non-indexed loans are generally higher than on indexed loans and, as a result, debt service can be considerably higher in the beginning.

What is the difference between fixed and variable interest rates?

Variable rates can increase and decrease in line with market fluctuations and the economic environment, based on the current interest rate tariff at each time. This may be favourable or not, depending on how the rates fluctuate.

With fixed rates, you tie your rates for a specified period and hedge against interest rate fluctuations. Rates can be fixed for 36 or 60-month periods. Fixed-rate loans carry a pre-payment charge.

Car loans

We fund up to 80% of purchase price for up to 7 years and offer better terms on electric vehicles. A credit assessment is only required if the loan amount exceeds ISK 2,700,000 for individuals or ISK 5,400,000 for married or common-law couples.

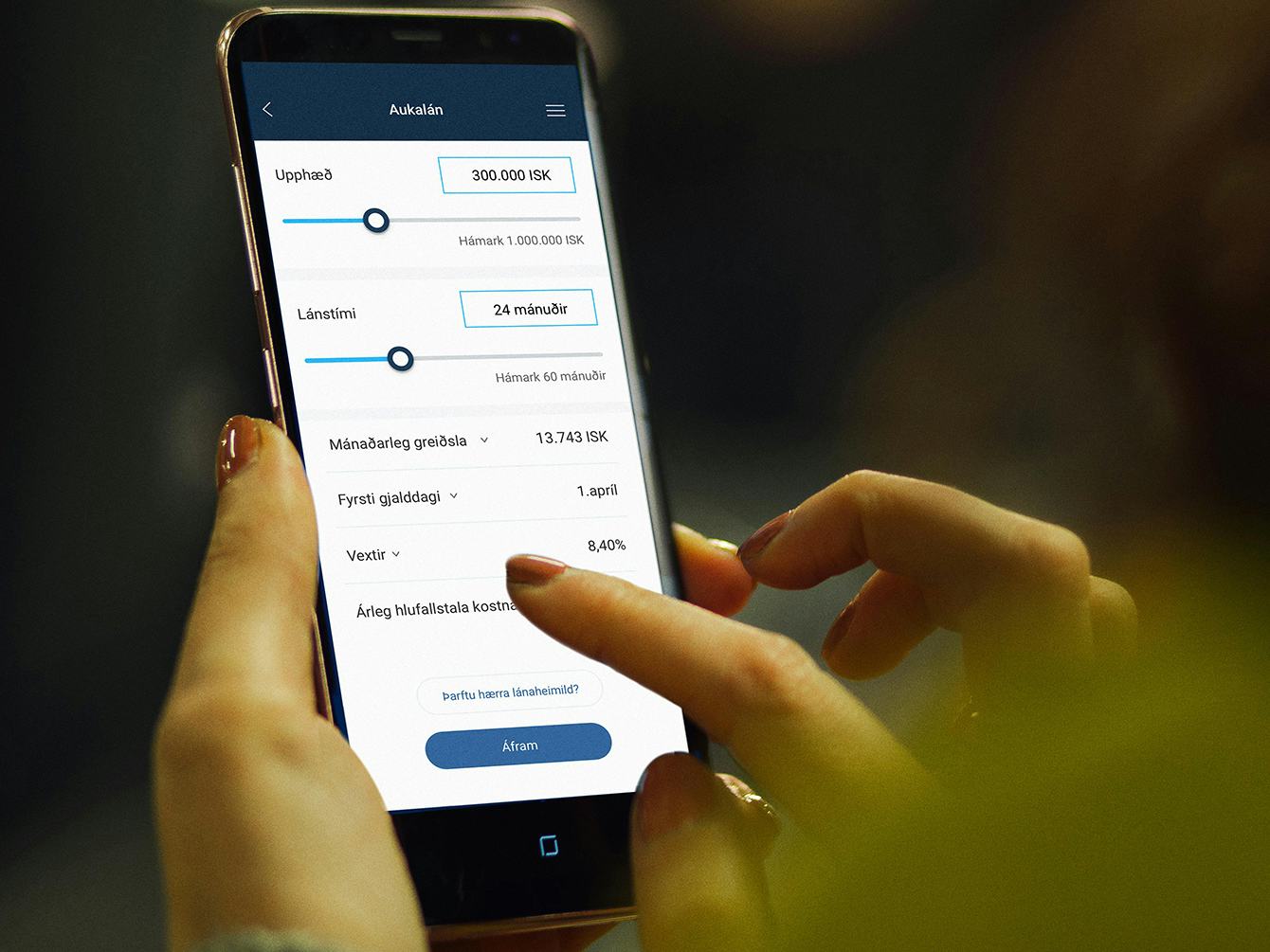

Aukalán loan

Need to shoulder unexpected expenses? Aukalán loans are a good choice in many cases. You can get the loan anytime and anywhere, and receive the funds immediately. You can apply for an Aukalán loan in the app.

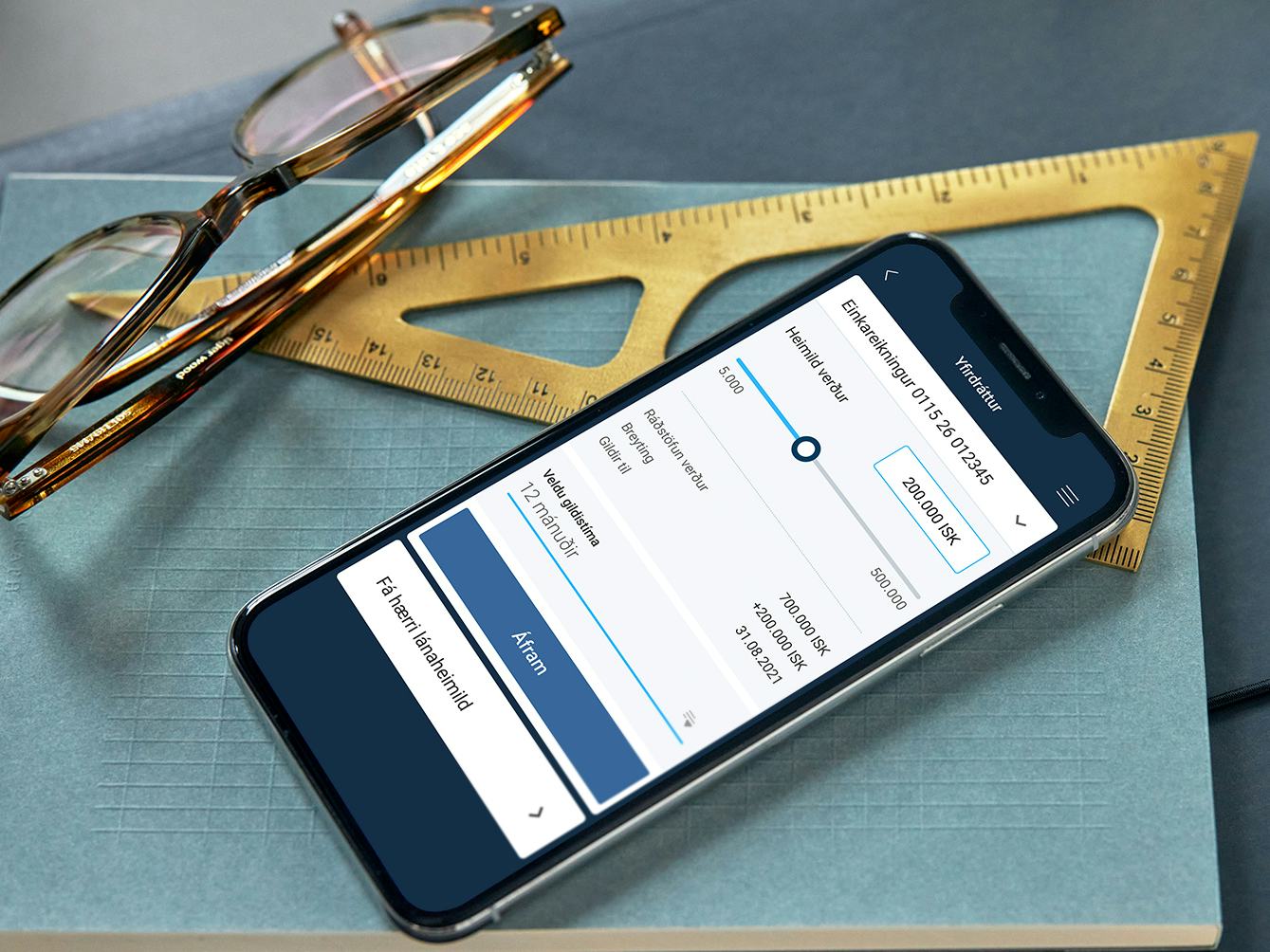

Overdraft

An overdraft is a flexible loan issued to a debit card account in the form of an authorisation. This type of loan is suitable to meeting temporary or unexpected expenses. You can apply for an overdraft in the app and online banking.

Join our group of satisfied customers

Applying for access to online banking and the app, creating an account and getting a debit card is a matter of minutes.